2023 national aggregate home price forecast to end year 1.0% below fourth quarter of 2022: Royal LePage

First quarter expected to show double-digit year-over-year declines, with modest quarterly price growth in the second half of next year

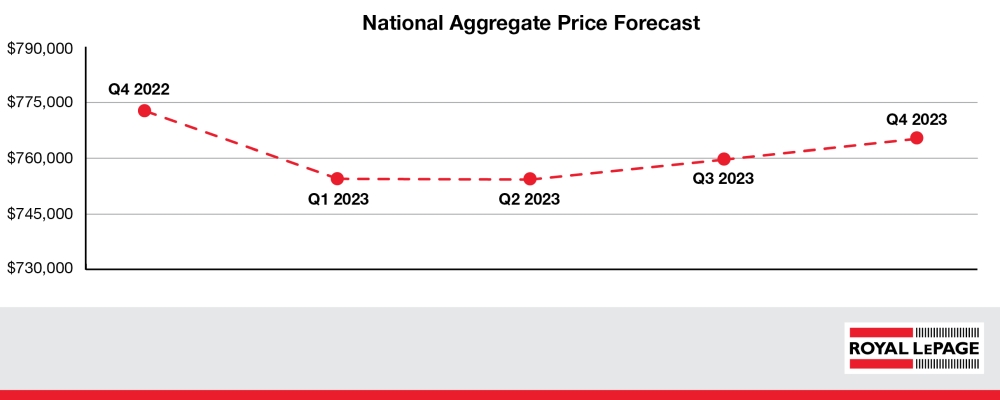

- On a quarter-over-quarter basis, prices expected to flatten in Q2 and begin modest improvement in second half of the year, ending 2023 on upward trajectory; release includes national aggregate quarterly forecast for 2023

- Condominium prices expected to outperform single-family homes in all major markets except Edmonton and Winnipeg

- Greater regions of Toronto and Montreal forecast to see Q4 2023 aggregate price decline of 2.0% year-over-year

- Q4 2023 aggregate home price in Greater Vancouver projected to dip 1.0% year-over-year

- Despite declining affordability, heightened by rising interest rates, continued housing supply shortage acts as a floor on home price declines

TORONTO, December 13, 2022 – Since the Bank of Canada began raising interest rates aggressively in March of this year, home prices in many major markets across Canada have been decreasing. The rate of decline, however, has been modest. According to the Royal LePage Market Survey Forecast, the aggregate[1] price of a home in Canada is set to decrease 1.0 per cent year-over-year to $765,171 in the fourth quarter of 2023, with the median price of a single-family detached property and condominium projected to decrease 2.0 per cent and increase 1.0 per cent to $781,256 and $568,933, respectively.[2]

TORONTO, December 13, 2022 – Since the Bank of Canada began raising interest rates aggressively in March of this year, home prices in many major markets across Canada have been decreasing. The rate of decline, however, has been modest. According to the Royal LePage Market Survey Forecast, the aggregate[1] price of a home in Canada is set to decrease 1.0 per cent year-over-year to $765,171 in the fourth quarter of 2023, with the median price of a single-family detached property and condominium projected to decrease 2.0 per cent and increase 1.0 per cent to $781,256 and $568,933, respectively.[2]

“After nearly two years of record price appreciation, fueled by a steep climb in household savings, very low borrowing costs and an overwhelming desire for more space during the COVID-19 pandemic, the frenzied housing market overshot and the inevitable downward slide or market correction began, intensified by rapidly rising borrowing rates,” said Phil Soper, president and CEO, Royal LePage. “In an era characterized by the unusual, this correction has not followed historical patterns. While the volume of homes trading hands has dropped steeply, home prices have held on, with relatively modest declines. We see this as a continuing trend.”

Soper continued, “Much focus has been directed at the negative impact of rising rates; there has been far less discussion on factors supporting home prices.”

The higher cost of borrowing erodes affordability, which historically has pushed people out of the market, reducing demand and resulting in falling home prices. Conversely, there are a number of factors supporting home prices in the current environment.

The supply of homes for sale must exceed demand in order for prices to drop materially. Canada is struggling with an acute, long-term housing supply shortage. Organic demand is supported by the current lifecycle of our large millennial demographic and a record number of new immigrants who need to be housed. Smaller household sizes mean more housing units are needed per capita than in the past. Pent-up demand is growing from buyers who have the ability to transact but have chosen not to in these turbulent times.

Low unemployment, and a large buffer of unfilled job vacancies, means that few families are likely to need to sell their homes for financial reasons. Homes are modestly cheaper today than at the height of the pandemic boom, offsetting some of the impact of rising rates, and household savings remain above long-term norms, making it easier to overcome down payment hurdles.

“Traditional wisdom says that a recession triggers widespread job losses and missed mortgage payments. People are forced to sell or the bank forecloses and lists the property, flooding the market with new listings when demand is weak. In this post-pandemic period, people have kept their jobs. In fact, they have seen wages and salaries rise,” said Soper. “We have a tightly managed national mortgage portfolio, with historically low default rates, supported by homeowners who have been required to qualify for a loan under the strict federal stress test for the last five years. And, we can’t forget that Canada has been grappling with an acute shortage of homes overall. We simply don’t see the factors at play that would result in a large drop in home values.”

While home prices nationally are forecast to see modest quarterly gains in the third and fourth quarters of 2023, values are expected to remain lower than the same periods in 2022 throughout the year. The aggregate price of a home in Canada is forecast to be 12.0 per cent lower in Q1 of 2023, compared to the same quarter in 2022, reflecting a 2.4 per cent decline over the fourth quarter of 2022. In the second quarter of next year, the national aggregate price is forecast to be 7.5 per cent lower year-over-year, and remain virtually flat on a quarterly basis. In the third quarter, homes are expected to be 2.0 per cent lower year-over-year, reflecting a 0.7 per cent increase on a quarterly basis. And, in the fourth quarter of 2023, the national aggregate price of a home is expected to end the year 1.0 per cent below the same quarter in 2022, an increase of 0.8 per cent quarter-over-quarter.

“Comparing prices to the previous year, the first quarter of 2023 should show the deepest decline in home values,” said Soper. “At that time, we will be comparing 2022’s final weeks of pandemic housing market excess – when home prices reached historically high levels – to a much quieter market, where values have had a full year to moderate. We expect year-over-year comparisons to show progressively less price decline as the year goes on, with small week-to-week improvements in the third and fourth quarters, allowing Canadian home values to end 2023 essentially flat to where we are today.”

The recovery is not expected to be evenly distributed. Regional markets that saw more moderate price growth during the pandemic real estate boom are expected to experience more modest declines. Due to their relative affordability, cities like Calgary, Edmonton and Halifax are expected to record modest price gains in 2023, as they continue to attract out-of-province buyers, especially first-time homebuyers from southern Ontario and British Columbia looking for more affordable housing.

While home prices have come down from the record highs recorded in the first half of this year, they remain well above pre-pandemic levels. The projected aggregate price of a home in Canada in the fourth quarter of 2023 is expected to sit 15.0 per cent above Q4 of 2020, and 18.4 per cent above Q4 of 2019.

Without a significant increase in housing supply, a return of buyers to the market, some driven by very high rental rates, should start to put upward pressure on prices again. And, in a tight-inventory market, sellers will remain hesitant to list their properties if they are unable to find a move-up home to purchase.

“It’s important to note that many would-be buyers currently sitting on the sidelines have not been forced to exit the market. While some of these families have been priced out for now by rising borrowing rates, we believe some have voluntarily adopted a wait-and-see attitude, not wanting to buy a property today that may be worth less tomorrow. Yet people in their thirties, forties and fifties have known only a Canada where home prices rise faster than incomes. When interest rates appear to have stabilized, these buyers may jump back into the market, anticipating a return to escalating home values,” concluded Soper.

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

MARKET SUMMARIES

Greater Toronto Area

In the Greater Toronto Area, the aggregate price of a home in the fourth quarter of 2023 is forecast to decrease 2.0 per cent year-over-year to $1,056,734. During the same period, the median price of a single-family detached property is expected to decline 2.5 per cent to $1,329,413, while the median price of a condominium is forecast to increase modestly by 1.0 per cent to $701,243.

“The city of Toronto and the surrounding regions have seen some of the steepest price declines in the country since interest rates began climbing earlier this year. Still, home prices remain out of reach for many would-be buyers, putting a lot of extra pressure on the rental market, which has seen prices spike in recent months,” said Karen Yolevski, chief operating officer, Royal LePage Real Estate Services Ltd. “We believe the bulk of the price correction in the GTA has already occurred and that a return to more normal trends is on the horizon.”

Yolevski noted that activity levels are expected to pick up again by the middle of next year, provided interest rates stabilize and consumer confidence is restored.

“Lack of supply is still a huge challenge in southern Ontario. I expect buyers who have been waiting for prices to level off will encounter increased competition when they re-enter the buying cycle, specifically in the more affordable condo segment, although not at the levels seen in 2021 and early 2022,” said Yolevski. “Development has slowed as a result of labour shortages and the increased cost of construction materials. A significant boost in inventory will be needed in the coming years to satisfy sidelined demand and an increasing number of newcomers.”

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

Greater Montreal Area

In the Greater Montreal Area, the aggregate price of a home in the fourth quarter of 2023 is forecast to decrease 2.0 per cent year-over-year to $532,238. During the same period, the median price of a single-family detached property is expected to decrease 2.5 per cent to $588,315, while the median price of a condominium is forecast to dip 1.5 per cent to $421,383.

“The increase in borrowing costs, everyday consumer goods and, more recently, municipal taxes, combined with weaker demand, should continue to put downward pressure on prices in Greater Montreal in 2023,” said Dominic St-Pierre, vice president and general manager, Royal LePage Quebec. “While the price correction is now mostly behind us, we’re forecasting that prices will continue to decrease slightly in the first half of the year, before rebounding modestly over the following six months, once interest rates have stabilized. At that point, it is expected that many buyers who have adopted a wait-and-see attitude will return to the market.”

As they wait for the economic situation to improve, families in Montreal will continue to seek ways to address their reduced budgets and disposable income. The household savings rate, which has remained surprisingly higher than during the pre-pandemic period, is expected to shrink as inflation continues to squeeze Canadians. As a result, buyers will look to condominiums as an alternative, given their relative affordability. Single-family homes are likely to see greater price declines than the condominium segment, since these properties appreciated the most during the pandemic boom, yet entry-level detached homes remain out of reach for many, especially first-time buyers.

“The Greater Montreal Area remains likely to attract buyers from other Canadian provinces, due to the real estate market’s relative affordability, as it did in 2022. On the other hand, the market has already begun feeling the effects of the two-year ban on foreign buyers, which is set to come into effect on January 1st. While a slight increase of international buyers entered the market when the announcement was made, demand from foreign buyers has diminished significantly as the year comes to a close,” noted St-Pierre.

Despite these disruptions and the projected decline in home prices, buyers who purchased a residential property before the onset of the pandemic have seen an appreciation of nearly 25 per cent today, compared to the end of 2019.

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

Greater Vancouver

In Greater Vancouver, the aggregate price of a home in the fourth quarter of 2023 is forecast to decrease 1.0 per cent year-over-year to $1,216,611. During the same period, the median price of a single-family detached property is expected to decline 2.0 per cent to $1,644,538, while the median price of a condominium is forecast to increase 1.0 per cent to $747,299.

“Although many buyers are still sitting on the sidelines, activity levels are showing signs of a return to seasonal norms in Greater Vancouver. Attractive properties in sought-after neighbourhoods that are priced properly continue to sell quickly,” said Randy Ryalls, managing broker, Royal LePage Sterling Realty. “With supply still well below what is required for the market to be considered balanced, I expect we will begin to see prices stabilize in the spring and summer, when some sidelined buyers return to the market.”

Ryalls added that with limited move-up inventory available, many sellers are hesitant to list their properties.

“The supply shortage is a self-fulfilling cycle. Sellers won’t list their home if they cannot find another property to purchase. Despite weakened demand in the second half of this year, the lack of available inventory has kept prices in the region from declining further. And, if activity picks up in the new year as expected, it will not take long for tight competition to challenge buyers once again.”

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

Ottawa

In Ottawa, the aggregate price of a home in the fourth quarter of 2023 is forecast to increase 2.0 per cent year-over-year to $739,602. During the same period, the median price of a single-family detached property is expected to rise 1.0 per cent to $850,117, while the median price of a condominium is forecast to increase 2.0 per cent to $378,114.

“We are anticipating moderate home price growth in the Ottawa market by the end of 2023,” said John Rogan, broker of record, Royal LePage Performance Realty. “Condominiums will likely see greater price appreciation than other property types, including in the single-family detached segment, as higher borrowing costs will continue to limit buyers’ purchasing power and push them to the lower end of the market.”

Rogan added that declining sales in the city in the second half of 2022 are indicative of what is likely to be a slow start to the new year. Presently, local housing activity has been largely motivated by buyers and sellers who are forced to move, including those relocating for work.

“Interest rates will continue to significantly impact home prices in 2023. If interest rates stop increasing, or even decline next year, we could see a spike in home prices and a resurgence of buyer demand from those who have been waiting on the sidelines,” added Rogan. “However, sales would increase gradually, as depleted inventory levels are unlikely to be replenished quickly enough to keep up with renewed purchaser demand.”

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

Calgary

In Calgary, the aggregate price of a home in the fourth quarter of 2023 is forecast to increase 1.5 per cent year-over-year to $612,451. During the same period, the median price of a single-family detached property is expected to rise 1.0 per cent to $701,142, while the median price of a condominium is forecast to increase 2.5 per cent to $239,543.

“Price declines in Calgary’s real estate market are unlikely next year. Unlike Canada’s major urban centres, which saw steep increases during the pandemic boom followed by rapid declines over the last six months, the Calgary market has experienced less drastic swings,” said Corinne Lyall, broker and owner, Royal LePage Benchmark. “I expect we will continue to see moderate price growth in the entry-level market, particularly in the condominium segment, which remains very active and has recorded double-digit sales growth this year. This segment will lead Calgary’s price growth in 2023.”

Lyall noted that Calgary continues to see demand from out-of-province buyers, particularly first-time buyers from Ontario who are seeking affordable housing options in a major city setting. In addition, condominiums are popular among out-of-province investors. A lack of available inventory, especially in the single-family detached segment, remains a challenge for buyers and continues to put upward pressure on prices, particularly in the lower end of the market.

“Buyer demand has remained consistent, and I anticipate Calgary’s real estate market will continue to see a steady pace of activity. There are many buyers hovering on the sidelines, waiting for the right product to hit the market,” said Lyall. “I expect activity will remain strong throughout the winter, with a normal seasonal slowdown in December and January before picking back up in the spring.”

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

Edmonton

In Edmonton, the aggregate price of a home in the fourth quarter of 2023 is forecast to increase 1.0 per cent year-over-year to $442,683. During the same period, the median price of a single-family detached property is expected to rise 2.0 per cent to $491,436, while the median price of a condominium is forecast to decrease 1.5 per cent to $198,281.

“Edmonton’s housing market continues to experience a shortage of inventory compared to pre-pandemic levels, which is helping to keep home prices in check and the overall market balanced,” said Tom Shearer, broker and owner, Royal LePage Noralta Real Estate. “As home buying budgets continue to shrink due to the rising cost of living and higher lending rates, we expect that sales activity will remain relatively flat in 2023. As a result, we are anticipating near level price growth at the end of next year, with a majority of price appreciation expected to occur in the highly sought-after single-family detached segment.”

Shearer noted that many buyers from outside of Alberta and elsewhere in the province continue to enter the city’s housing market. Since the beginning of February, demand has been strong from Ontario and British Columbia buyers looking to relocate to Edmonton, due to its relative affordability and healthy job market.

“Continued strong interprovincial demand will help to keep Edmonton’s market healthy and balanced at the start of the new year and through the spring. I expect a return to normal seasonal trends next year, with increased activity in the summer and a slight pullback through the fall,” said Shearer.

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

Halifax

In Halifax, the aggregate price of a home in the fourth quarter of 2023 is forecast to increase 0.5 per cent year-over-year to $479,285. During the same period, the median price of a single-family detached property is expected to rise 0.5 per cent to $544,610, while the median price of a condominium is forecast to increase 1.5 per cent to $407,015.

“I expect that home price growth in Halifax will be virtually flat in 2023. With interest rates expected to stabilize in the early part of next year, demand is likely to pick up again in the spring, after sales volumes reached a two-decade low this year,” said Matt Honsberger, broker and owner, Royal LePage Atlantic. “Buyers have been sitting on the sidelines waiting for prices to reach their bottom, and sellers have been holding back until interest rates stop rising and buyers come back to the market.”

Honsberger noted that inventory remains extremely low in the region, and without a significant boost in supply, the anticipated increase in demand will put upward pressure on prices next year.

“While real estate activity in 2023 is unlikely to reach the exuberant levels recorded in the first half of this year, Halifax’s population continues to grow and attract buyers from across Canada and abroad. I anticipate that we will see a return to more normal seasonal trends next year.”

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

Winnipeg

In Winnipeg, the aggregate price of a home in the fourth quarter of 2023 is forecast to decrease 1.0 per cent year-over-year to $368,181. During the same period, the median price of a single-family detached property is expected to rise 1.0 per cent to $410,565, while the median price of a condominium is forecast to decrease 3.0 per cent to $243,082.

“Winnipeg’s housing market activity has been more reflective of pre-pandemic norms lately, signaling that the 2023 market should return to seasonal trends. I expect to see typical winter activity levels in the coming months, followed by a boost in momentum heading into the spring,” said Michael Froese, broker and manager, Royal LePage Prime Real Estate. “I expect annual sales activity will remain below 2022 levels next year, as rising everyday household expenses constrain buyer budgets and limit their purchasing power.”

Froese added that housing supply levels remain low compared to historical norms, but expects to see an improvement in the new year as ongoing supply chain challenges are remedied and housing starts pick up across the province.

“Demand for single-family homes will continue to drive the majority of activity in the market. Most buyers still prefer a detached home, but with inventory levels well below the five-year average, condo prices are not expected to decline significantly. Overall, I believe we are moving toward a more healthy and balanced market next year, provided interest rates stabilize soon,” said Froese.

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

Regina

In Regina, the aggregate price of a home in the fourth quarter of 2023 is forecast to decrease 1.5 per cent year-over-year to $361,495. During the same period, the median price of a single-family detached property is expected to decline 2.0 per cent to $389,648, while the median price of a condominium is forecast to increase 1.0 per cent to $221,796.

“Many homebuyers are adjusting to the new realities of higher mortgage rates, and have reduced their buying budgets as a result. Any price appreciation we see next year will be in the condominium segment and the lower end of the market, as some buyers have been priced out of the single-family segment,” said Mike Duggleby, broker and owner, Royal LePage Regina Realty.

Duggleby noted that the recovery is not likely to roll out evenly, with investors scooping up lower priced properties before prices begin to rise again.

“Activity has certainly slowed compared to the historical highs seen during the pandemic boom. I expect we’ll see a return to a normal seasonal slowdown in the winter months before picking up again in the spring, although it will not be as vibrant as we’ve seen the last two years.”

There has been a significant increase in foreclosures in Regina this year, and Duggleby expects the trend will continue next year, as overleveraged homeowners see their historically-low fixed-rate mortgages come up for renewal.

Royal LePage 2023 Market Survey Forecast Table: rlp.ca/table_2023forecast

Royal LePage 2023 Quarterly Forecast Table: rlp.ca/table_2023quarterlyforecast

Royal LePage Royalty-Free Media Assets:

Royal LePage’s media room contains royalty-free assets, such as images and b-roll, that are free for media use.

- Media room: ca/mediaroom

- Royalty-free assets: ca/media-assets

About the Royal LePage Market Survey Forecast

The Royal LePage Market Survey Forecast provides year-over-year and quarter-over-quarter price expectations for Canada’s nine largest markets. Housing values are based on the Royal LePage National House Price Composite, produced through the use of company data in addition to data and analytics from its sister company, RPS Real Property Solutions, the trusted source for residential real estate intelligence and analytics in Canada. Commentary on housing and forecast values are provided by Royal LePage residential real estate experts, based on trend analysis and market knowledge.

About Royal LePage

Serving Canadians since 1913, Royal LePage is the country’s leading provider of services to real estate brokerages, with a network of approximately 20,000 real estate professionals in over 600 locations nationwide. Royal LePage is the only Canadian real estate company to have its own charitable foundation, the Royal LePage Shelter Foundation, dedicated to supporting women’s and children’s shelters and educational programs aimed at ending domestic violence. Royal LePage is a Bridgemarq Real Estate Services Inc. company, a TSX-listed corporation trading under the symbol TSX:BRE. For more information, please visit www.royallepage.ca.

For further information, please contact:

Stephanie Matthias

North Strategic on behalf of Royal LePage

stephanie.matthias@northstrategic.com

(416) 802-1612

[1] Royal LePage’s aggregate home price is based on a weighted model using median prices and includes all housing types.

[2] Price data, which includes both resale and new build, is provided by Royal LePage’s sister company RPS Real Property Solutions, a leading Canadian valuation company. Price forecast reflects Q4 2023 over Q4 2022 projections.